Preparing for What Is Coming Your Way

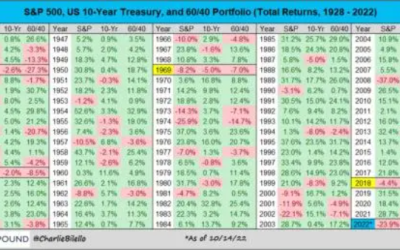

We are in the middle of a historic financial situation. Take a moment and look at this chart. Through mid October, stocks (S&P 500) AND bonds (10yr US Treasury) AND 60-40 allocation are negative. The yellow indicates this is the...

Social Security Benefits Get Biggest Bump In 41 Years – Is It Enough?

This article details the upcoming fourth highest Social Security COLA since 1975. That's good and bad news. Good news is, a higher benefit is on the way. Bad news is, actual inflation costs are most likely double the benefit on the...

Bond Alternatives for Fixed Income Allocations

This Financial Advisor article exposes a flaw that many savers still believe about bonds being a defensive hedge and counter-balance to equities in an asset allocation. Bonds are securities, and risk assets, and are exposed to capital losses and those...

4 Tips for Minimizing Financial Anxiety

If you’ve woken up in the middle of the night to a money-related panic attack, you’re not alone. Our financial situation dictates so many parts of our everyday life. That said, excessive stress is a concern that should be addressed. Money-driven anxiety is a growing...

Thoughtful Term Insurance – Now Available

Almost everyone knows they need to have at least simple term insurance to protect their family. If you've avoided getting insurance because you thought it would be expensive or didn't want an insurance agent bothering you, I know how you feel. I feel the...

Is it Always Better to Purchase a Home?

Homeownership is a dream for many people, but is it for everyone? For some, buying a home is a rite of passage, a sign that they’ve grown up and succeeded. However, there are some things to consider before you decide to buy your first home. Sometimes, buying a home...

5 Best Arguments for Life Insurance (besides the death benefit)

Read this classic article from Ed Slott, CPA which originally ran on Feb. 5, 2016. His article made a lot of sense in 2016 and makes even more sense nowadays! The Secure Act killed the "stretch" IRA, US Government debt surpassing $31 trillion AND...

Financial Planning in Your 30s: 3 Goal Ideas for 30-Somethings

30 can be a divisive number. Some see it as the time you’re thrown into full-blown adulthood, whether you’re ready or not. Others consider 30 the early years before your true confidence shines; in your career, relationships, or even in yourself. Either way, your...

Financial Planning Basics: Creating and Maintaining a Budget

Whether you’re earning a six-figure salary or just out of college, many people feel budgeting is essential. Especially with the current economic climate, having a budget that you stick to may help keep spending under control, improve your savings, help you plan for...